Residential Market

Residential Market | Offices | High Street | Shopping Centres | Logistics | Hotels | Visión 2022

Rising inflation, together with other variables such as access to financing at low rates, instability in stock markets, and the growing demand for new construction, have fuelled a 7.4% increase in prices in Seville over the last year.

Jose Luis Bravo | Director. Residential Sales.

Jose Luis Sanz | Director. Residential. Capital Markets

Seville is increasing its weight in new construction in the region and is becoming a pole of attraction for investors seeking residential projects or to reactivate traditional areas through the development of new projects. In addition, the replacement housing market and even second homes for local demand within the province is experiencing an increase to be taken into account in the coming years.

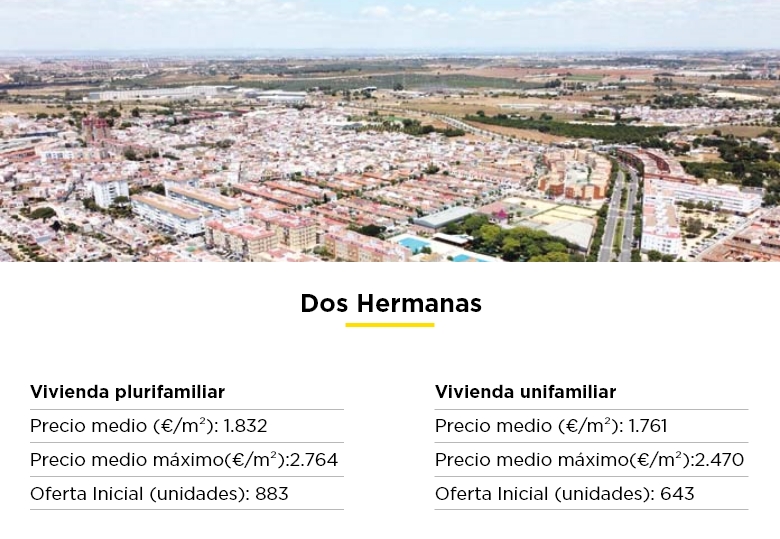

As far as registered transactions are concerned, they are mainly concentrated in the second-hand market, as is the case in the rest of the national market. However, the second-hand market suffered a slight decline in 2021 compared to 2020 and the development and sale of new-build projects has seen a 100% increase compared to 2017 data. From the last quarter of 2020 onwards, a return to normality was observed in which the recovery has gradually been confirmed with growth and reactivation of the new and second-hand market. The number of approvals increased by 50% in 2021 compared to 2020, indicating a greater dynamism compared to previous periods. Dos Hermanas is the location with the greatest supply in the province, where the development of Entrenúcleos stands out, which in recent years has become a reference point in the city. The land market in Seville has been undergoing a strong recovery for several years in the capital and in neighbouring municipalities, such as Camas, Tomares, Dos Hermanas and Mairena del Aljarafe.

Seville has become the number one target for the acquisition of land and the development of real estate projects for most of the large developers. Large areas of residential and tertiary development have become trophy assets for groups with different profiles. • Palmas Altas • Sevilla Este • Hacienda Rosario • Entrenúcleos

Others, such as Pítamo Sur, are examples of large-scale projects where, as urban development milestones are reached, interest from the investment market will be confirmed. Prices are in the range of €200-500 per buildable sq m. Of course, there are exceptions, such as some prime areas in Nervión, where scarcity is pushing prices up to the €1,500/bsqm benchmark. In any case, the land market in Seville is currently in a period of stable growth and in an environment of maximum interest on the part of the investment demand, both local, with very strong and high-liquidity groups, and foreign.