High Street

Residential Market | Offices | High Street | Shopping Centres | Logistics | Hotels | Visión 2022

The Seville High Street market returns to pre-Covid levels of activity, driven by increased activity from new entrants.

Juan Pedro Hernández | Director. Retail High Street

In recent years, the prime area of the city has experienced significant activity with the entry of new national and international operators, such as the relocation of Tous or the arrival of Aristocrazy, Primor, Miniso or Five Guys.

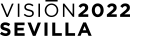

The increase in operator turnover, the arrival of new brands and the increase in availability have marked the activity of recent years. With regard to rents, there was a general decline in secondary areas, mainly due to increased availability. On the other hand, the prime area has managed to stabilise the average rent level, even materialising occasional operations with a slight increase, to around €153/sq m/month (average of the maximum value in the area). The boom that the Seville market is experiencing after the pandemic, recovering levels of national and international tourism, together with rents in its prime area at lower stress levels than other cities of similar characteristics, is motivating operators to position the city among their priorities. In terms of investment, there has been a surge of interest from national and international funds and family offices seeking higher returns than those available in more liquid markets such as Madrid or Barcelona.